45l tax credit multifamily

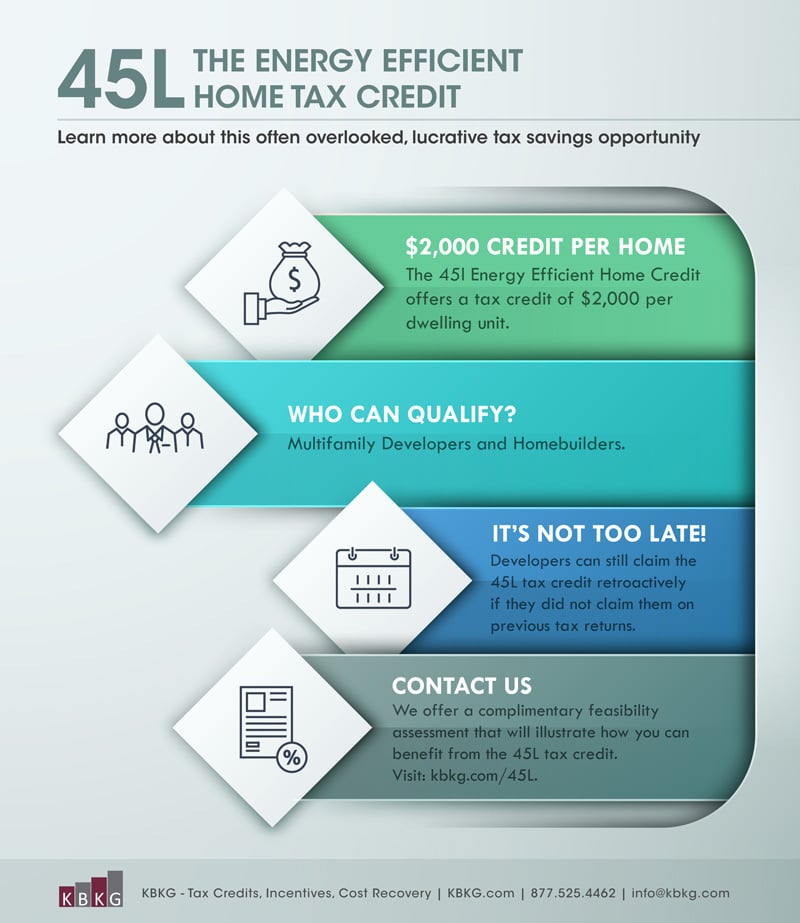

These types of projects are eligible for the 45L tax credit. 45L is a federal tax credit for energy efficient new homes Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements.

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

Taxpayers also have the ability to amend returns to claim missed tax credits from previous years.

. 45L Tax Credit for Multi-Family Apartments Home Builders The 45L Tax Credit is a valuable tool that provides builders and developers with tax credits for residential and apartment buildings. Single-family Homes Apartments Condos Townhouses Home Builders. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of.

The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in the year that unit is sold or leased as a residence. OUR SERVICE Our 45L Tax Credit team includes HERS raters and tax professionals who will perform free assessments to prequalify your homes. The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021.

Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties. Key provisions impacting the multifamily industry include the following. 45L Tax Credit Viridiant is here to help you get a 2000 tax credit per unit on your property.

Each unit in a multifamily residential facility may qualify. If youre renovating or rehabbing a multifamily property with three-stories or feweror have previously done soyou could be eligible for the 2000unit tax credit if the improvements both. 45L Tax Credits For Multifamily Dwellings Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011.

Because the 45L tax credit is paid per housing unit it has the most significant impact on multi-family housing projects such as apartments condominiums townhomes student housing as well as assisted living facilities. Department of Energy approved software CHEERS uses Micropas a Department of Energy DOE approved software to create 45L certificates. The 2000 tax credit per building unit is available to developers and builders of properties that are 50 more energy-efficient than a similar property built in 2006.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. What is the 45L Tax Credit. The credit provides a dollar-for-dollar offset against taxes owed or paid in the tax year in which the property is sold or leased.

Available for single-family multi-family less than 3 stories homes sold 2017-2021. The Section 45L tax credit which rewards multifamily developers with tax credits of 2000 per energy efficient apartment unit. This credit was extended retroactively in late 2019 for 2018 and 2019 thru December 31 2020.

45L Tax Credit for Energy Efficient Home Section 45L or Energy Efficient Residential Tax Credit has been recently extended through the end of 2021. Each newly contractor built energy efficient residential dwelling purchased from the contractor and used as a residence over the last few years is eligible for. The 45L tax credit is an energy-efficient tax credit for residential properties.

Housing units must have at least one room a kitchen a living room and a sleeping area. The 45L Tax Credit applies to single-family homes as well as apartment complexes assisted living facilities student housing and condominiums. And you could receive a 2000 per unit tax credit.

Among other extensions this bill retroactively extends the Code Section 45L tax credit providing multifamilyapartment builders with a tax credit of 2000 per energy efficient unit. Builder 2000home 45L Energy Efficient Tax Credit. Properties which must be three stories or lower must incorporate energy-efficient features such as high R-value insulation and roofing HVAC systems andor windows and doors.

Most eligible multi-family projects qualify for the 2000 Energy Efficient Home Tax Credit due to strict California building code. How To File For The 45L Tax Credit To file for the 45L tax credit you must first obtain the necessary certifications to verify that the property meets all the above-mentioned standards of energy efficiency. 45L Tax Credit 45L is for residential and multi-family properties.

The Section 45L tax credit had expired at the end of 2011 but this bill extends the tax credit for two years through 2013. In December 2019 the President signed a 14 trillion spending package covering numerous tax extenders including the 45L Energy Efficiency Tax Credits for multifamily residential developers which was extended through 2020. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards.

In many states most new residential projects qualify for this credit. In December 2020 an additional Bill was enacted into law which extends the 45L credit through December 31 2021. If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company.

The bill extends the tax credit for another two years through the end of 2013 and can be claimed by any eligible contractor on From 8908. Its ability to be applied to substantial reconstruction and rehabilitation as referenced in the Section 45Lb3 is often overlooked. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain conditions.

Multi-family units up to three stories high are eligible for the 45L Energy Efficiency Tax Credit. The tax credit is 2000 per dwellingper unit and can be claimed by the builderdeveloper s of an energy-efficient home. Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are eligible for a 2000 tax credit for each new or rehabbed energy efficient dwelling unit that is first leased.

Single family and custom spec homes duplexes ADUs apartments condominiums multi-family projects 3-stories above grade and less.

Affordable Housing Developers Investors Additional 2 000 Tax Credit

45l The Energy Efficient Home Credit Extended Through 2017

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

Tax Benefits For Multifamily Rehabilitation Property Projects

45l Tax Credit Energy Efficient Tax Credit 45l

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Tax Benefits For Multifamily Rehabilitation Property Projects

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

Tax Credit Extended For Home Builders Multifamily Developers Bkd

Section 45l Tax Credit Case Study Apollo Energies Inc

The Proposed Build Back Better Act Makes Significant Changes To The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

179d Tax Credits Source Advisors

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services